50+ how much can i borrow mortgage based on my income

Web Find out how much house you can afford with our mortgage affordability calculator. Web If your down payment is 25001 or more you can find your maximum purchase price using this formula.

This Chart Shows How Much Money You Should Spend On A Home Mortgage Help Best Mortgage Lenders Interest Only Mortgage

Take Advantage of Your Hard-Earned VA Mortgage Benefits.

. What mortgage can I. Get 0 Down No PMI and More. Generally speaking most prospective homeowners can afford to finance a property whose mortgage isbetween two and two.

Web Front-end only includes your housing payment. Save Time Money. Compare Home Financing Options Online Get Quotes.

Check Eligibility for No Down Payment. Get Instantly Matched With Your Ideal Mortgage Loan Lender. Usually banks and building societies will offer up to four-and-a-half times the annual income of.

Web Assuming relatively low debts 300 per month and a 30 mortgage rate this person might be able to borrow up to 564000 for a mortgage. Ad More Veterans Than Ever are Buying with 0 Down. Ad Get Preapproved Compare Loans Calculate Payments - All Online.

Web For example if your monthly income is 5000 and your mortgage is 2500 per month and its the only debt you have your DTI is 50your debt is 50. Ad Find How Much House Can I Afford. Web Mortgage lenders will consider your loan-to-value ratio LTV the amount youre borrowing compared to the overall cost of the loan.

See how much house you can afford. You can get an estimate for this amount through a mortgage pre-qualification or for more. Get 0 Down No PMI and More.

Down Payment Amount - 25000 10. Web Your gross monthly income is generally the amount of money you have earned before your taxes and other deductions are taken out. Web How much do I need to make for a 250000 house.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. However many lenders let borrowers exceed 30. Typically the higher your deposit the.

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best. Take Advantage of Your Hard-Earned VA Mortgage Benefits.

Web The first step in buying a property is knowing the price range within your means. Lenders usually dont want you to spend more than 31 to 36 of your monthly income on principal interest. Web DTI compares your monthly gross household income to the monthly payments you owe on all your debts including housing expenses.

Web Your salary will have a big impact on the amount you can borrow for a mortgage. Easily Compare Mortgage Rates and Find a Great Lender. First Time Home Buyer.

The Trusted Lender of 300000 Veterans and Military Families. Web A good rule of thumb is that the front-end ratio based on PITI should not exceed 28 of your gross income. As an example if youre taking out a loan of 250000 for 25 years and paying an interest rate of 350 pa your monthly repayments will be 1252.

A 250000 home with a 5 interest rate for 30 years and 12500 5 down requires an annual income of 65310. For example if you pay 1500 a month for. Web The usual rule of thumb is that you can afford a mortgage two to 25 times your annual income.

Web When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings - so the more youre committed to spend each month. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Ad More Veterans Than Ever are Buying with 0 Down.

Web Your repayments like the amount of interest you pay and how much you can borrow in the first place will depend on a number of factors. Get an estimated home price and monthly mortgage payment based on your income monthly. Thats a 120000 to 150000 mortgage at 60000.

Ad Talk to a Loan Officer about Home Mortgage Refinancing Cash Out or Bill Consolidation. Check Eligibility for No Down Payment. Web How Much Mortgage Can I Afford.

Our borrowing power calculator gives you an initial estimate of what a lender. Web Borrowing Power Calculator Want to find out much you can borrow for a home loan.

The Best Mortgage Lenders Of 2022 Bankrate Awards

Mortgages For Over 50s Homeowners Alliance

Should I Buy A House Or Invest In Stocks Quora

Livemore Mortgages

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Affordability Calculator How Much House Can I Afford Zillow

Instant Online Loan In Nigeria The Best Loan Apps In Nigeria Loanspot

How To Plan Manage Your Money While Unemployed Moneygeek Com

How Much Can I Borrow Calculator Moneysupermarket

Should I Pay Off My Mortgage Early The Motley Fool Uk

What Asshole Designed Credit Score Algorithms My Score Dropped Almost 50 Points Solely Because I Paid Off A Credit Card Literally Nothing Else Changed Over Last Month R Assholedesign

Can I Get A Mortgage If I M Over 50

Cumulative Distribution Of Total Wealth And Financial Assets At Death Download Scientific Diagram

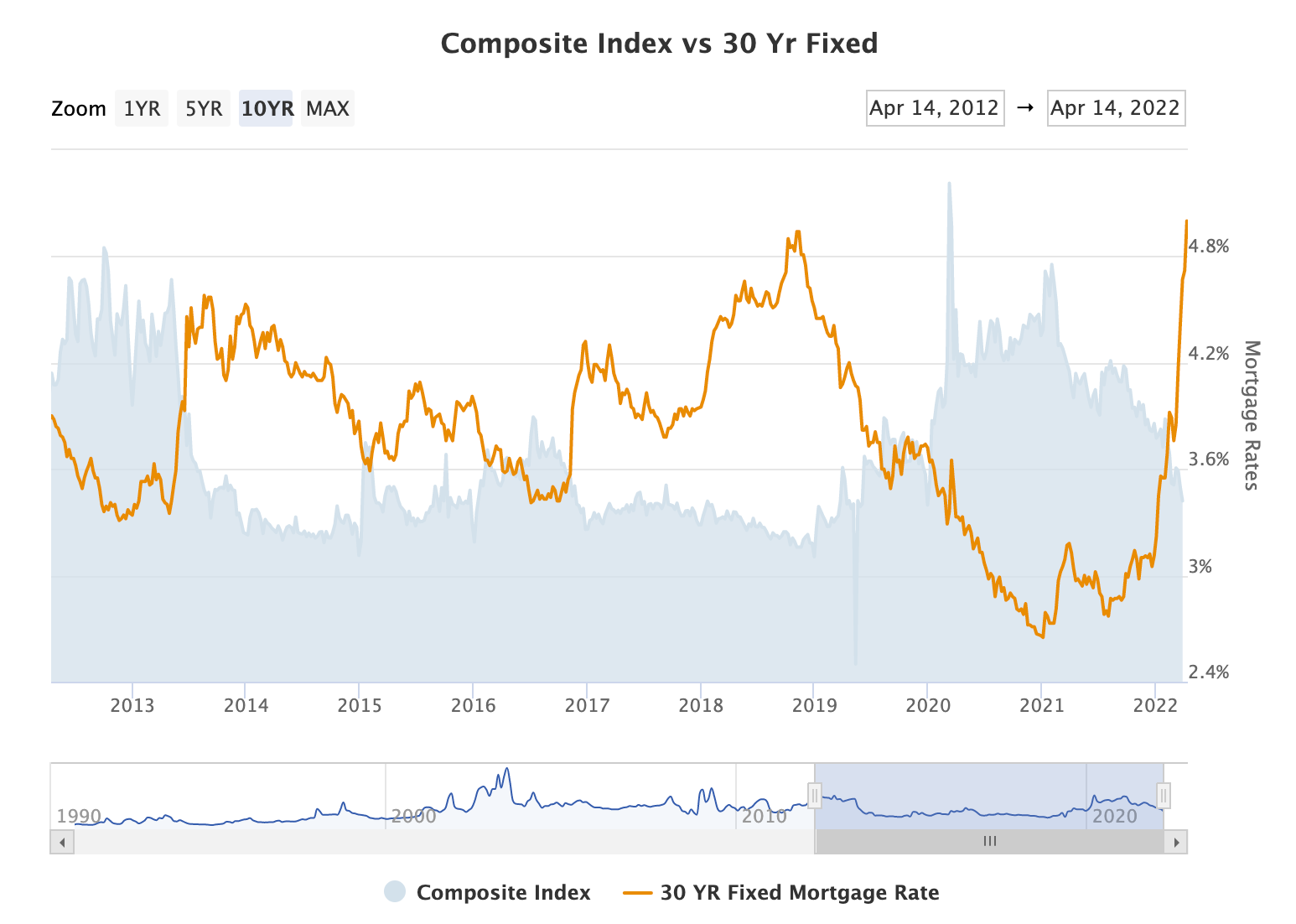

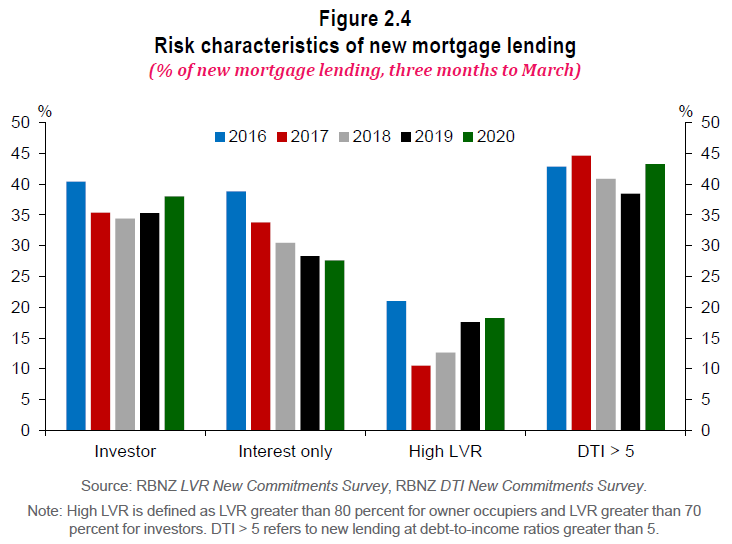

Rbnz Analyses Housing Negative Equity Risks Interest Co Nz

The Income Required To Qualify For A Mortgage The New York Times

Should The Rbnz Increase The Ocr By 25 Or 50 Basis Points Interest Co Nz

The Mortgage Brain Gloucester